Operating expenses include both fixed and variable costs and directly impact operating margins. Expense forecasting involves estimating the costs required to support projected revenue, including direct costs (COGS) and operating expenses. Note that accumulation can lead to more severe consequences in the future. For example, if you don’t invest in projects or stimulate the interest of investors, your revenue can decrease. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Finance Strategists has an advertising relationship with some of the companies included on this website.

Analyzing the Impact of Assumptions on Financial Projections

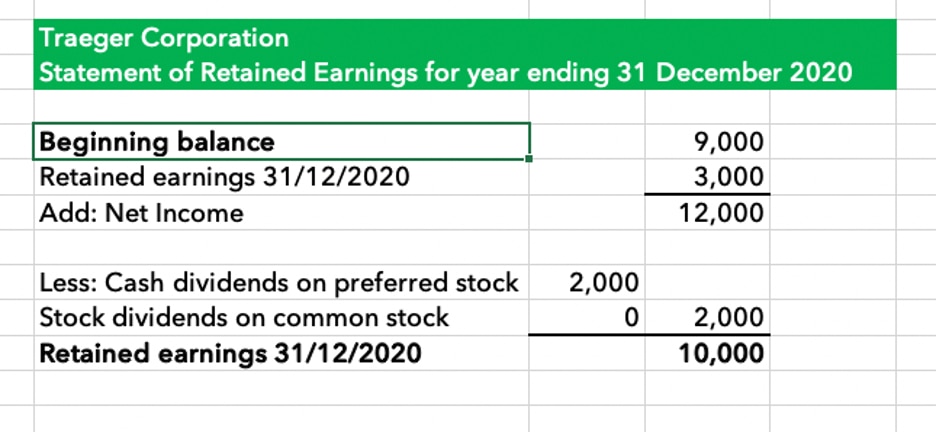

Even small changes in assumptions can lead to significant differences in projected outcomes, impacting revenue, expenses, cash flow, and profitability. By examining the impact of these assumptions, businesses can identify key drivers, assess risks, and make better-informed decisions. Here’s a comprehensive guide on analyzing the impact of assumptions on financial projections. You calculate retained earnings by combining the balance sheet and income statement information. For an example, let’s look at a hypothetical hair product company that makes $15 million in sales revenue. Rather, it could be because of paying dividends to shareholders, capital expenditures, or a change in liquid assets.

What is the difference between retained earnings and revenue?

Want to make sure your retained earnings calculations are accurate? You can learn more about FreshBooks by visiting their official website. Retained earnings represent a company’s total earnings after it accounts for dividends.

Forecasting Techniques for Revenues, Expenses, Capital Expenditures, and Working Capital

While retained earnings signal the potential for wealth creation through reinvestment, they do not equate to immediate financial affluence. Their essence is strategic, more a story of growth and potential than a snapshot of wealth. Understanding these differences prevents confusion and leads to more informed financial planning and decision-making.

- This analysis may include calculating the business’ retention ratio.

- Each statement influences and depends on the others, providing a holistic view of a company’s financial health.

- Walking through this example, it’s evident that Zippy Tech is maintaining a healthy cycle of profit reinvestment while also rewarding its shareholders.

- You can track your company’s retained earnings by reviewing its financial statements.

Pour too much into dividends, and the retained earnings dwindle, possibly signaling a lack of internal investment capital. But strike the right balance, and you’re likely to attract investments while still rewarding shareholders. It’s about signaling stability and foresight in your business model. Calculating the ending retained earnings solidifies tax shelters your company’s financial narrative, reflecting both past decisions and setting the stage for future investments or debt management. It’s a number that tells a story, so make sure it’s penned with precision and clarity. When you subtract dividends from your net income, you’re essentially closing the loop of your retained earnings calculation.

Brex for startups.

If your company pays dividends, you subtract the amount of dividends your company pays out of your retained earnings. Let’s say your company’s dividend policy is to pay 50 percent of its net income out to its investors. In this example, $7,500 would be paid out as dividends and subtracted from the current total. After subtracting the amount of dividends, you’ll arrive at the ending retained earnings balance for this accounting period.

The retention ratio (also known as the plowback ratio) is the percentage of net profits that the business owners keep in the business as retained earnings. If your company has a dividend policy and you paid out dividends in that accounting period, subtract that number from net income. This happens if the current period’s net loss is greater than the beginning period balance.

Note that the amount of dividends reported in the statement of retained earnings doesn’t include dividends on preferred stock. They’re reported on the income statement as a subtraction from net income and not as an expense because they’re not tax-deductible. The statement of retained earnings is a financial document that summarizes how the company’s retained earnings—aka the revenue they’ve kept after paying for expenses—changed during a given period. These funds can be used towards the development of the company such as research and development or infrastructure development.

It’s a crucial part of the financial story, speaking volumes about your company’s ability to generate and manage profits. Should your company decide to pay dividends, the exact amount you distribute nibbles away at the net income’s contribution to retained earnings. If no dividends are paid, you skip this step entirely – easy as pie. When your company has had a fruitful year, you might want to share the love with shareholders through dividends. These payouts are like a “thank you” to the investors who bank on your success.

Decisions related to dividend distribution and appropriation of earnings are in the hands of management and the board. Accountants need this information and management’s guidance before signing off on the statement of retained earnings. While it’s sometimes referred to as the statement of stockholders’ equity, statement of owner’s equity, or equity statement, these technically aren’t the same thing.

A company that routinely gives dividends to shareholders will tend to have lower retained earnings, and vice versa. To better explain the retained earnings calculation, we’ll use a realistic retained earnings example. Let’s say that a marketer named Elena is looking to expand her agency, but needs to provide some information about retained earnings to attract new investment. Although preparing the statement of retained earnings is relatively straightforward, there are often a few more details shown in an actual retained earnings statement than in the example. The par value of the stock (its declared value at issuance) is sometimes indicated as a deeper level of detail.